STRATEGIES TOWARDS SUPPLY CHAIN TO MITIGATE SIMILAR IMPACT TOWARDS WORLD ECONOMY

“STRATEGIES TOWARDS

SUPPLY CHAIN TO MITIGATE SIMILAR IMPACT TOWARDS WORLD ECONOMY”

Prepared by:

Dr. Ashan Silva

(Chartered

Marketer [CIM-UK])

AFNI (UK), CMILT (UK), ACIM (UK),

DBA, MBA, CIM (UK) Ex. MBA, Ex. MSc (Strategic Marketing)

Whole world comfortably followed their globalization concept until we reached this catastrophe, we are experiencing now which has been stared from year 2020. Manmade and ecological reasons contributed equally to this and first we should identify those in detail to avoid any similar in future.

According to the journal explanation economy

is one out of main three dimensions of globalization namely political and

cultural globalization. Economic globalization is expanding because of

integration of production, finance, markets, labor with various countries and

through various agreements like free trade agreements.

In a way researchers explain the same as

interaction and integration of people, business and governments across the

world.

Globalization is basically movements of

services and products among the countries and is a complicated process which is

affecting to economy, culture, environment, social, and political background of

the countries.

This became one of the main tools to break

trade barriers between countries and help each other to reach their economic

growth.

Globalization is depending on different

factors such as

Political / geographical / sociological /

cultural / technological / financial / economic and production.

Therefore, to mitigate the impact of this

globalization to our business we should have a proper management plan in place.

That will help us to reach our desired goals.

As a result of globalization, similar

products might invade the planned market within very short period with a very

competitive price which is having a similar or more quality than your product.

Globalization reached as a wave to the world

and first wave started in 19th century and retained till beginning

of first world war and the second commenced after World War two and continuing

till today (figure – 01).

Figure - 01

Source:

- https://ourworldindata.org/trade-and-globalization

Reduction of transitional cost effected a lot

for this trade expansion and development of technology became one of the major

factors for this expansion. Due to drastically development of marine, aviation

and land transportation sectors, transportation cost reduced significantly and

said reasons enhanced trade volumes within cross countries at the level of intra

industrial trade (exchange of similar good and services).

Same time this became one of the

main reasons for this catastrophe. World supply chain totally governed and

benched marked by economic efficiency.

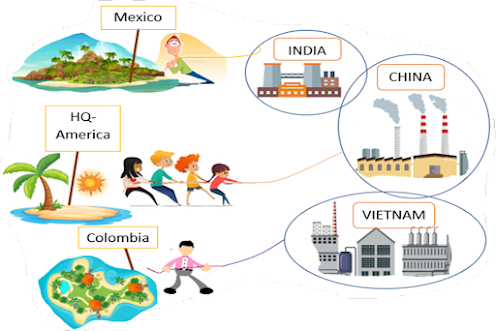

Manufacturers commenced their

hunting for cheap labor markets and diversified their production line to those

countries to control their production cost. As a result, for one product, they

have used several markets to produce their components. Markets like China,

Vietnam, India, etc. are the best examples.

Sametime closest raw material

sources also became one of the prime factors and when the resources are close

to each other, then they have chosen that market for their production. Final

they brought all those components to one place to complete their final product

(assemble). iPhone is one of the biggest examples we can take for this.

Across the world we are experiencing

an economic inflation due to shortage of supplies into the market. This is

mainly due to reasons like pandemic condition which we have faced recently,

geopolitical conditions created by superpowers in the world. E.g., Russian

action against Ukraine, Action by China for the world trade, etc.

When China taking their own

decisions to control their pandemic condition, most of the countries

automatically effected due to this production diversification actions taken by

many countries to control their production cost to compete in this competitive

market.

Most of the production line became

stand still until they receive the other component to complete their task

(China became the battery producer for most of the well-known brands in the

automobile sector). In that way the whole production became stand still for a

while and that gap is still there in the market. As a result, continuous supply is disrupted

and now supply is not there to the market as per demand. Hence prices of most

of the goods are skyrocketing continuously hand in hand with inflation.

With this experience now we should

learn a lesson and need to have firm strategies within the organizations to

avoid any similar bottlenecks in future. Companies should have their own

production lines to cover each leg of the supply chain. Should not depend upon

some other resources or services to compete their task.

Companies should not have a single

vendor strategy. They should have at least two suppliers for the same product.

It is much better if they can diversify it for two different markets.

According to researchers’ studies,

they have identified reshoring as one of the main to control this disruption.

Re

shoring

The process to bring back the

production lines back to companies’ origin is called as re shoring. The world

has learned a lesson in a hard way by off shoring their production lines

expecting a better return for their investments. Specially during the period of

pandemic disruption.

Due to the latest inflation

pressure, organizations and governments are hunting for the corrective and

preventive actions for the same to come out of this and to place an action plan

to mitigate the impact if any similar in future. Within that process they have

identified this off shoring mechanism due to globalization as one of the key factors

for this supply chain disruption. As a result, now they are considering about

re shoring them back towards their soil or nearby to cover following main

reasons,

·

Economic security

Creation of supply shock as a result

of COVID (High freight cost).

As

an example, below gauges (figure – 02) showing supply shortages for U.S.

services and industry,

Figure – 02

Source:

- Bloomberg Economics.

Logjams & pandemic created a huge imbalance in supply and demand (Figure 03) in the world market. As one of the main transportation modes by sea, containerized cargo played a significant role within this pandemic period. World market has faced a significant container shortage and led to a drastic container price inflation. The same has been badly affected towards the inflation of the economy and GDP in most of the countries in the world.

Figure

– 03

Source:

- United Nations Conference on Trade and Development (UNCTAD)

·

Climatic Changes

Decarbonizing programs, Extreme

weather (Droughts/ hurricanes / tornadoes / flooding / Heavy rain or snow

falls/ etc.) will create a significant impact upon companies bottom line. All

those implications will play a role in price and inflation.

As Alicia Wallace explained through

her article under heading of “Extreme weather could push food prices even

higher” in CNN Business which she has published on 14th September

2022. She took various examples like below to explain the same.

“As the United States continues to battle high inflation,

the effects of prolonged droughts and extreme weather events could help keep

the heat on prices for a long time to come.

The Consumer Price Index, which

measures price changes for a basket of goods and services, showed

inflation hit 8.3% in August from

the year before. But food prices rose at an even faster pace, increasing by

11.4% during that period, according to the

Bureau of Labor Statistics”.

“Extreme weather also can negatively affect companies’

bottom lines”, according to research from Paul Griffin, professor of management

at UC Davis.

Heat effect found that every

degree over 77 degrees Fahrenheit (25 degrees Celsius) translates into an

annualized loss of sales of 0.63% and a profit margin decrease of 0.16%. Stock

prices dropped by an average of 22 basis points in response to a

heat spell, Griffin found.

Corn crops that died due to extreme heat and drought during a

heatwave in Austin, Texas, on Monday, July 11, 2022.

Source: - Alicia Wallace CNN Business / Jordan

Vonderhaar/Bloomberg/Getty Images

·

Shifting of competitive landscape

Change of operating cost from

country to country with time.

E.g., Years ago, Chinese labour cost

is much lower than Mexico labour cost, but at present it’s almost same due to

various reasons. So, to US market Mexico is the closest (Figure – 04).

Figure - 04

Source: Record calculations, US Bureau of Labor Statistics, Bank

of Mexico, China National Bureau of Statistics, Conference Board TED, IMF World

Economic Outlook. BLS estimations until 2012 for Mexico and 2008 for China.

Thereafter, series are expanded using manufacturing unit labour cost per

employee index for Mexico, and manufacturing wages divided by total economy

hours worked (assuming similar work hour trends between sectors) for China,

converted at average exchange rates for the year.

Transport cost for the final product and timelines to reach the

same to the final consumer market will improve or can be control through such near

shoring action. (Near shoring is the mechanism shifting the production lines &

assembling lines to neighboring countries) This will support to control the bottle

necks (e.g., supply demand gap) countries are facing within their consumer

market and finally to control their inflation due to freight rates (figure –

05), transportation timelines, congestions, climatic disruptions, geopolitical

actions, pandemic actions, etc. which the world has experienced recent past.

Figure

– 05

Source:

- FBX

·

National Security

The dependence upon certain supplies

through various countries.

E.g., China and Taiwan dispute,

Semiconductor shortage for

electrical vehicles and smart phones in the world. Taiwan is holding a major

share within semiconductor exporters in the world.

The interest of China towards Taiwan

created a bottleneck to this semiconductor supply. To overcome this shortage US

and other countries, those who are using such semiconductors for their

production had to invest large sums of money to regrow the semiconductor

industry within their countries from the scratch.

E.g., Russian GAS supply to Europe.

Russia is the largest energy

supplier to Europe. Due to ongoing geopolitical conflict between Europe and

Russia (Russian action against Ukraine), at present Europe is enduring a

partial natural gas cut-off.

According to IMF there is a risk of

shortage of as much as 40% of gas consumption and GDP shrinking by up to 6%.

(Source: - imf.org).

Dependence on Russia for gas, and other energy sources, varies

widely by country (Figure – 06)

(Figure –07)

Figure – 06

Source: - IMF staff Calculation /

imf.org

Figure - 07

Source: - IMF staff Calculation /

imf.org

With all above now effected

countries should diversify their efforts to secure their supplies through the other

global LNG suppliers to mitigate the energy shortage and encourage their

community for maximum energy savings until they come out of it.

As a result, now manufactures should

think about reshoring their production and encourage their investors to invest

in their soil rather allowing them to carry out their production in the other

territories.

This way manufactures will have much

more control in their production and will be able to mitigate any similar production

disruption in future.

Some countries already identified

this by looking at their uncontrollable inflation hike. Mr. Joe Biden president

of USA have taken some action in their legislation addressing this issue.

In addition, nearshoring and friend

shoring became another alternative to address this issue. When we consider

nearshoring, as same as the other controlling factors, if their own soil is not

suitable, they can consider about the neighbouring countries for their supply

chain requirements, if so, they can control any such disruption much more

effectively and efficiently than they faced in last pandemic condition.

Friend shoring is about using their

friendly neighbours to fulfil the supply chain requirements rather any hostile

unpredictable entities.

So, we can use above few strategies

hand in hand with other identified actions through various sectors to

strengthen each individual economy. Organizations, manufactures and governments

should strongly think and use their strategists to place their short/mid- and

long-term strategies towards their supply chain addressing all those bottlenecks

which they have faced.

Because no one will be able to predict

any such similar disruptions will not surface again in the world market.

So, it’s our duty to learn from the past

and revamp or reinforce our strategies to face any such similar in future with

minimum impact.

Bibliography

Web Sites: –

·

https://fbx.freightos.com/freight-index/FBX

References: –

·

Extreme weather could push

food prices even higher

https://edition.cnn.com/2022/09/14/economy/heat-inflation-economy-drought/index.html

·

Reshoring in perspective:

Rethinking global supply chains and the macroeconomic implications

·

A brief history of

globalization

https://www.weforum.org/agenda/2019/01/how-globalization-4-0-fits-into-the-history-of-globalization/

·

COVID-19: Managing supply

chain risk and disruption

·

Taiwan, Chips, and

Geopolitics

https://thediplomat.com/2020/12/taiwan-chips-and-geopolitics-part-1/

·

National security and

economic prosperity are two sides of the same coin

·

How a Russian Natural Gas

Cutoff Could Weigh on Europe’s Economies

THANK

YOU

14th

January 2023

Comments

Post a Comment