The importance of data analysis for strategic planning in Ship agency business

The importance of data analysis for

strategic planning in

ship agency business

Collection of data is playing a vital role

for our strategical planning. For to achieve “operational excellence” following

need to be covered

1.

Strategy development

2.

Performance management

3.

Process excellence

4.

High performance work teams

Under above segments there are many sectors

covered.

In addition to all above its very important

very important identify your customer base.

Specially

1.

Top ten customers volume wise

2.

Top ten customers income wise

3.

New customers secured within

specific time frame (annually or by annually)

4.

Lost customers within a

specific time frame (annually or by annually)

5.

If possible, the reason to said

customers

6.

The reliability of our business

segment within said top ten customers (percentage)

7.

Main competitors

8.

Disruptive competitors

Disruptive innovation with

demanding customers

We must be aware of and blind about above

areas will drive you through a real uncertainty within the business.

Mostly department management should be

aware about those areas to plan and implement their strategies to maintain

department performance. Rest of the staff can support them with their knowledge

and intel whatever they have in hand.

Characteristics of Disruptive & Sustaining

innovation

Sometimes certain managerial staffs are not

aware about those fundamentals, and they are trying to secure new customers and

businesses continuously from the market and not aware as they are losing some

of their existing customer base due to lack of attention on them. They can lose

their customer base due to some of the following such as

a.

Noncompetitive pricing structure

b.

Poor customer service

c.

Unethical practices by

competitors

d.

Customers went out from that

market segment

We might lose some customers with a reasonable reason where we are unable to patch that gap within our company policies. E.g., If a competitor is using unethical practices to win their customer base and if any of our customers trapped on to that and shift towards that competitor, we are helpless in that regard. Because we are unable to follow the same path with our company procedures. In that case we must identify them properly with such reasons and should continuously maintain our relationship.

Sometimes we should contemplate such lost

positively without demoralizing ourselves. Because occasionally competitors

will not be able to extend the service standard where your company have given

them in the past. Then the customer will experience difficulties to meet their

requirements same as with you’ll. Then they will decide to return back to

you’ll with burnt fingers and such customers will not move out easily from

you’ll with their bad experience within that market.

But we must maintain our investigation

tight about all those lost customers. Need to identify precisely those who have left us due to service

failures and pricing structure. This is very important.

Such areas should identify with immediate

effect and bridge those gaps with proper corrective actions to mitigate any

further loses.

To carry out all above we should have

proper data in hand. Example, annual customer base and product wise.

Based upon such data we can identify whom

we have lost or won within that given period. Then you’ll can commence

investigation to find out the reason for that win or lost through our intel.

If it is a win, we can identify what that customer has valued on us to use us for their operations and introduce such similar attractive elements to win many more from the market as well as to concert the existing customer base.

When we identify the customers went out

from our portfolio because of the pricing structure, we should evaluate our

pricing structure in detail with the market trend.

We should have a proper quoting procedure

based upon our operating cost. That operating cost should be studied as a breakdown

of hourly, daily, weekly, and monthly to ease the cost calculation process.

In addition, we should include customer

credit period, manhours, direct department other expenses (stationary,

Vehicles, communication, etc.) also into consideration.

Then we should come to a conclusion as what

would be our minimum quote. Based upon that figure we should declare a minimum

amount to quote to our principals. Otherwise, department and company will bleed

without notice.

If we lost any of our customer due to competitors

underquote, if so, we must check whether said quote is lower than our set

limits, then we can ignore the rectification actions. Because such approach

will create a negative impact on our bottom line with time. In addition, if we try to meet that quote to

compete with the competitor, it might affect badly to our existing loyal

long-time customer base those who are paying us more than the said amount. Even

competitors can use the same to create a conflict among us and our loyal

customers. So, better we stand down and maintain our stance. We can do this if

we are quoting our customers with a sense without over quoting at any given

time.

But if we lost the customer over and above our minimum quoting structure, that means we have some muscle to adjust ourselves, then we can try to secure them back again with some sensible adjustments.

So, with all above its obvious market

information will play a vital role when we do this type of pricing strategy.

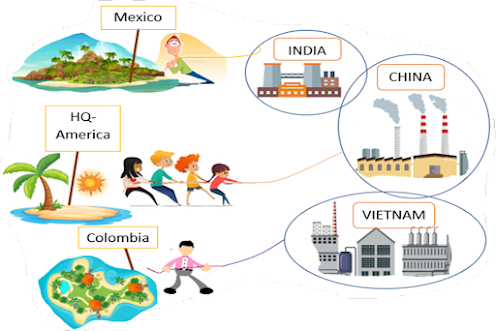

Sametime, sometimes we are much depending

upon few of our main customers. Since

the income is steady and fulfilling our budgeting targets, we are happy with

our approach. But sometimes management is not aware as our whole income is

depending on few main principal hands. If any of those principal goes out from

our customer portfolio, whole income, KPI’s, budget, etc. are in jeopardy.

So, we should control this dependence and we should move forward with a clear idea about our customer base. To come out of any such danger we should diversify our customer portfolio from those main principals by reducing the dependability on them.

To achieve that we should first identify

our top customers (volume wise as well as income wise). In addition, we should

calculate our dependability percentage with our main top ten customers. Based

upon the results we should place our strategies to mitigate the risk. If not,

we lose the whole grip of department performance if we lose any of those main

customers (top ten) from our portfolio.

01st

August 2021

Prepared by:

Ashan Silva

AFNI(UK), CMILT (UK), ACIM (UK)

Ex. MSc (Strategic Marketing), Ex. MBA, MBA, Reading for DBA

Comments

Post a Comment