Why Inventory management (Stock maintenance) became one of the key factors within supply chain management

“WHY

INVENTORY MANAGEMENT (STOCK MAINTENANCE) BECAME ONE OF THE KEY FACTORS WITHIN

SUPPLY CHAIN MANAGEMENT”.

Prepared by:

Ashan Silva

AFNI (UK), CMILT (UK), ACIM (UK),

Ex. MSc (Strategic Marketing), Ex. MBA, CIM(UK), MBA, DBA(ABD)

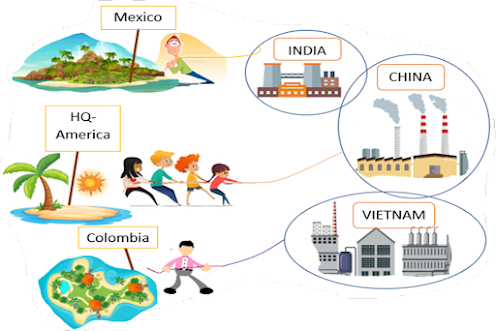

Flow of material is one of the key factors

in supply chain management.

Supply of material can be from local market

or from international market. Through whatever the way decides, we should make

sure uninterrupted smooth material supply to maintain a continuous production

cycle. But in practical world, due to various reasons this flow might

interrupt. Due to e.g., natural calamities (earth quacks, floods, snow falls,

etc.), pandemic lock downs, strikes, etc.

So, organizations are always maintaining their

material stocks to avoid any such production interruptions due to material

shortage.

Excessive stock holding is always a cost. For

certain products it’s a must. e.g., wine industry. But for most of the products

in the market it became an additional cost.

At present as a result of efficient

inventory management tactics, organizations manage to run their production

effectively and efficiently by maintaining minimum stock levels as stock hold. Said

tactics supported them to increase their ROA.

Following example indicating the same in

details

Company sales - 18 million

Stock level - 25% of sales

Stock holding cost - 20% of Value

Operating cost - 12 million

Other assets - 18 million

ROA -

???

Sales -

18 million

Stock level -

25% of sales

- 18 X 25/100

- 4.5 million

Stock holding cost - 20% of stock value

- Stock level X 20%

- 4.5 X 20/100

- 0.9 million

Operating cost - 12 million

Total ope. Cost - Ope. Cost + Stock holding cost

- 12 + 0.9

- 12.9 million

Net income -

Company sales – Total cost

- 18 million – 12.9 million

-

5.1 million

Other assets - 18 million

Stock -

4.5 million

Total

assets -

Other assets + Stock Level

- 18 + 4.5

-

22.5 million

Hence ROA (Return

on Assets) - Net income

%

Total assets

- 5.1 million X 100

22.5million

ROA -

22.7%

If the same

organization reduce their stock levels till 15% of sales, ROA will be

Company sales - 18 million

Stock level - 15% of sales

Stock holding cost - 20% of Value

Operating cost - 12 million

Other assets - 18 million

ROA -

???

Sales -

18 million

Stock level -

15% of sales

- 18 X 15/100

- 2.7 million

Stock holding cost - 20% of stock value

- Stock level X 20%

- 2.7 X 20/100

- 0.54 million

Operating cost - 12 million

Total ope. Cost - Ope. Cost + Stock holding cost

- 12 + 0.54

- 12.54 million

Net income -

Company sales – Total cost

- 18 million – 12.54 million

- 5.46 million

Other assets - 18 million

Stock -

2.7 million

Total assets - Other assets +

Stock Level

- 18 + 2.7

- 20.7 million

Hence ROA (Return

on Assets) - Net income %

Total assets

- 5.46 million X 100

20.7million

ROA -

26.4%

Through the

result of the above example, it is evident that, if we maintain efficient

inventory management system within the organization, that can increase their

ROA and it will positively support to boost shareholders wealth.

THANK

YOU

Comments

Post a Comment